What Are “Financial Capabilities” & Why Are They Important?

Q&A with Donna O’Connor, Hopelink Financial Coach

Hopelink: Let’s start at the beginning. What exactly is financial capability?

Donna O’Connor: We believe financial capability is someone’s ability to understand how to manage their money and navigate financial systems. Examples of that would be understanding money management or how to create a savings fund. Ultimately, it’s about how knowledgeable someone is about financial things.

So, what is the Financial Capabilities program and what services are offered?

DO: The Financial Capabilities team takes a broad holistic view of financial capability. We like to use the analogy of a three-legged stool to our approach. There are three components we focus on to support clients in reaching their financial goals.

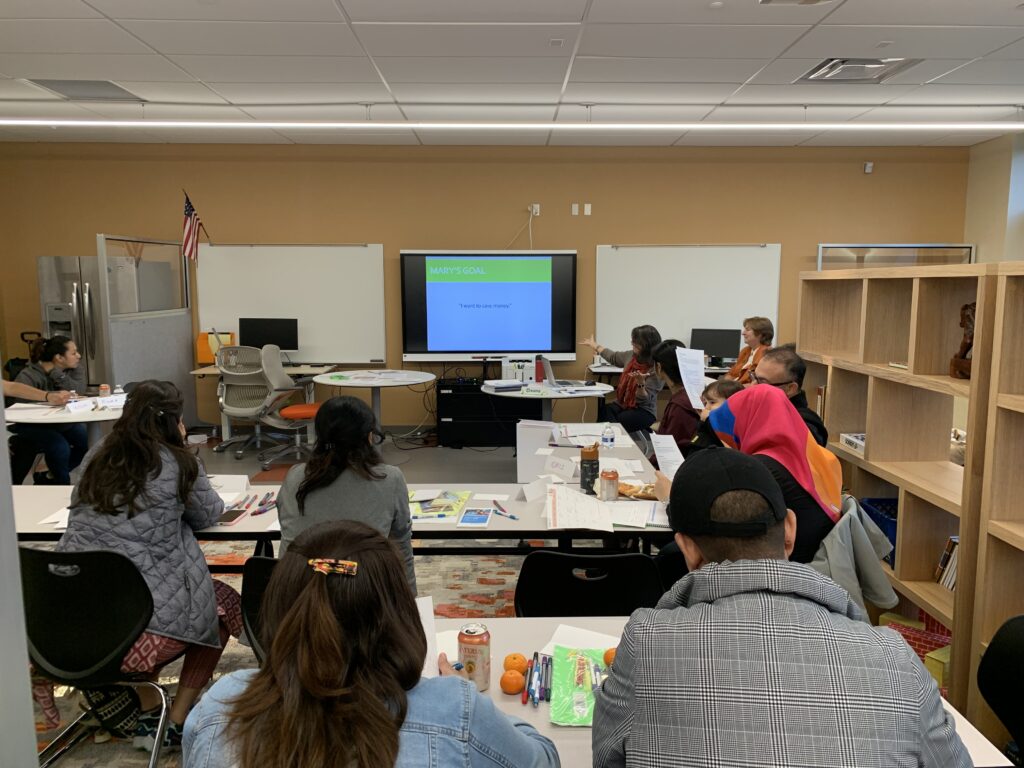

1) Gaining knowledge through financial education classes on topics such as money management, savings, banking, credit building, and debt reduction.

2) Building skills through financial coaching and counseling, providing an opportunity for clients to meet with a highly skilled, compassionate financial coach that will partner with them to discover their behaviors toward money and finances and create a plan for financial stability and security.

And finally, 3) providing information about financial products and services that are safe, effective, and affordable for folks through mission-aligned partnerships and resource connections.

We need those three things to be happening together. Our clients are incredibly capable so what we want to do is focus attention on building up skills and closing any knowledge gaps. We want clients to be able to use their newfound skills and knowledge in practice.

We offer classes, workshops, and opportunities for the community to come and learn about financial topics. They can range from building credit, managing money, understanding your relationship to money, banking during the holidays and much more! The other services we offer are financial counseling and coaching. This is where we look at the individual or sometimes, we see couples, and we establish financial behaviors and discover their relationship with money. From there, we can learn about the ways those relationships show up in the financial decisions that are being made. We go into each individual’s situation and talk it through to learn what’s happening to support them in creating a plan toward their financial goals.

Are there areas of financial wellness that clients want to learn about most? If so, what are they?

DO: Credit building is huge. That is one of the topics that is most talked about in the program. Debt is also on a lot of people’s minds right now. Student loan debt, in particular. But more than anything, we receive many clients who are overwhelmed and just want to know how to live day to day in an environment where it’s so expensive to live and folks don’t have enough to cover basic needs. We partner with clients to help them navigate that, so they don’t feel alone as they struggle with affordability.

What are the benefits of participating in the Financial Capabilities program?

DO: The biggest benefit to the program is having access to a financial coach in a safe, nonjudgemental space where they can talk openly. These are the types of resources folks don’t usually have access to unless they pay for them. When it comes to families that have low or moderate income, they usually don’t have a lot of options to talk to someone who truly has their best interest at heart.

Here, they can take a break from everything else they are dealing with, and just talk about what’s going on. And usually, in my experience, when they talk it through, they feel better and less stressed. From there, we can really partner together to figure out where the client wants to go from here.

What challenges do clients face when participating in the program?

DO: Some of the biggest hurdles clients have faced over the years is simply believing they can make the change they want to make. Many clients have been on such a long journey of not seeing positive outcomes. So, for us, it’s about working with them so they can find that hope and stick with it. It’s important for us to celebrate all the wins to keep building momentum.

Another challenge is how many different areas there are of financial wellness and how often the environment changes. For instance, credit scores are known to fluctuate every month and what’s on your credit report can change, so I think it’s hard for anyone to keep up with it all. What we try and do is unpack the situation and continue to partner with clients in a safe and comfortable environment. We reassure clients that we’re not here to judge you; we’re here to support you in creating an action plan to move toward financial wellness.

What are common misconceptions about the program and how does the team work toward deconstructing them?

DO: One misconception we hear about is most people think they need money or a certain type of income to budget their finances. You can still manage money with what you have and look toward longer-term goals. Another misconception is that some people think we provide direct financial assistance. People get confused between Financial Capabilities and the Financial Assistance program.

Finally, most people don’t know how deep we go into behavior change. We want to understand clients and support them in unpacking the reasons why they do what they do with money. There’s a lot of shame and guilt around money so it’s critical to ensure clients can continue to make the positive change they want to see in their lives.

Hopelink’s Financial Capabilities program partners with individuals as they learn to confidently and confidentially manage their money and achieve greater financial wellbeing. The program leads one-on-one coaching sessions with individuals, offers virtual financial drop-in sessions every Tuesday, and community workshops across the region.